In a world of rising costs and uncertain economic futures, investing is no longer optional—it’s essential. Whether you're aiming to retire early, buy your dream home, or simply beat inflation, smart investing is the key to long-term financial freedom. In this blog, we’ll break down the basics of investing, how to get started, and the common mistakes to avoid.

Beat Inflation: Savings lose value over time due to inflation. Investing helps your money grow faster than prices rise.

Build Wealth: Compound interest is one of the most powerful forces in finance.

Achieve Financial Goals: From buying a house to funding retirement, investments make those goals achievable.

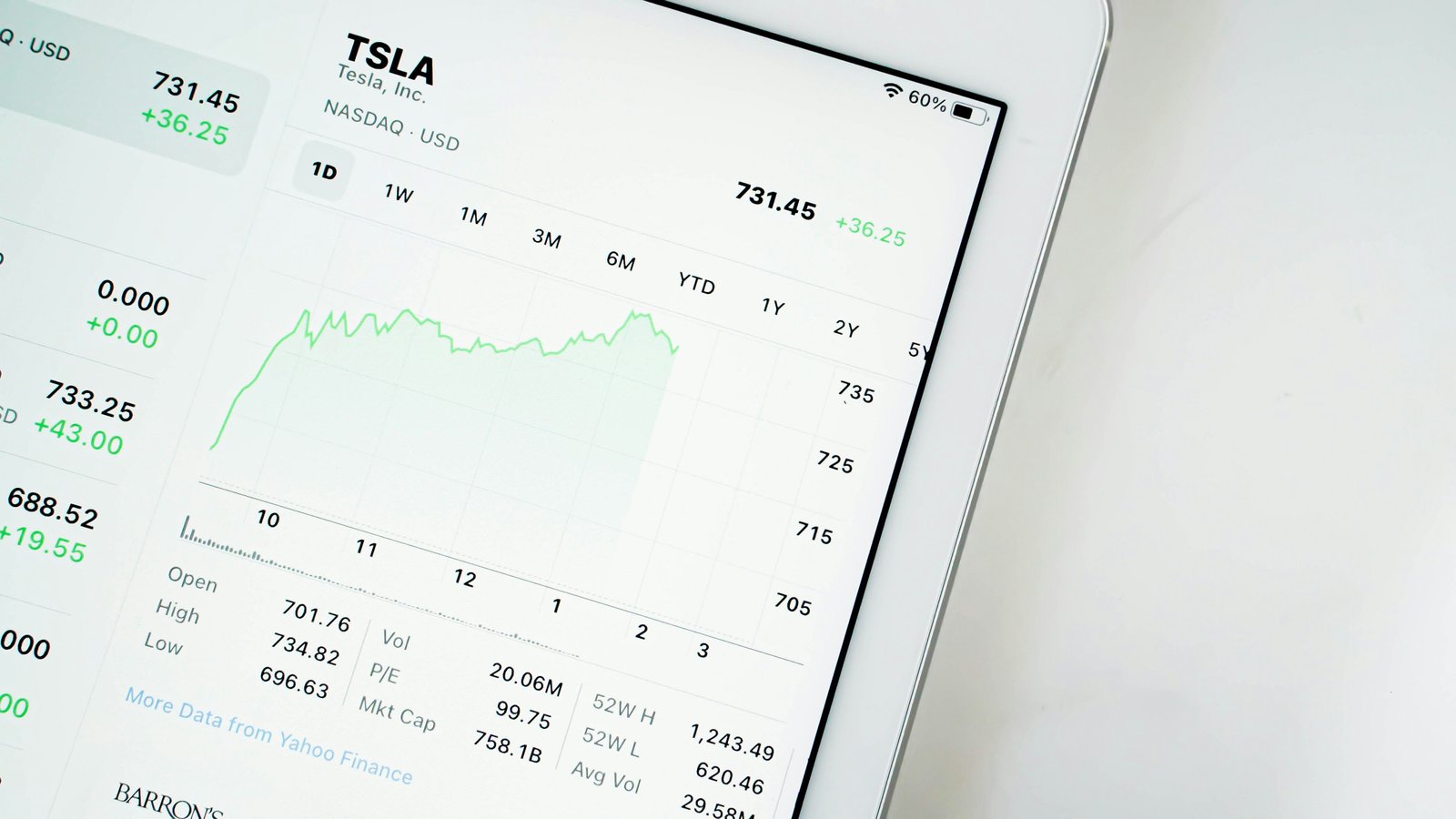

Stocks: Ownership in companies with potential for high returns (and risk).

Bonds: Fixed-income securities, generally lower risk than stocks.

Real Estate: Physical property for rental income or value appreciation.

Mutual Funds & ETFs: Diversified baskets of stocks or bonds—great for beginners.

Cryptocurrency: Digital assets with high volatility and high potential.

Set Financial Goals: What are you investing for? (retirement, travel, buying a house, etc.)

Build an Emergency Fund: Before investing, ensure 3–6 months of expenses are saved.

Understand Your Risk Tolerance: How much loss can you emotionally and financially handle?

Choose a Platform: Use trusted brokers like Vanguard, Fidelity, Robinhood, or apps like Acorns or Stash.

Diversify Your Portfolio: Don’t put all your money in one stock or asset class.

Stay Consistent: Consider dollar-cost averaging to invest regularly regardless of market conditions.

Trying to time the market

Investing without a plan

Ignoring fees

Following the hype (especially in crypto)

Panic selling during market dips

Think in decades, not days.

Reinvest dividends for compounding growth.

Review and rebalance your portfolio annually.

Stay informed but don’t react to every headline.

Investing is a journey, not a sprint. By starting today, even with small amounts, you set the foundation for a more secure and abundant financial future. The best time to invest was yesterday—the second-best time is now.