Are you looking to take charge of your financial future?

Discover the power of Systematic Investment Plan (SIP), a game-changing investment strategy that can pave the way for long-term wealth creation. In this guide, we'll delve into the intricacies of SIP, helping you understand its benefits, risks, and how to make the most of this smart investment choice.

“ Unlocking Financial Success with SIP: A Comprehensive Guide”

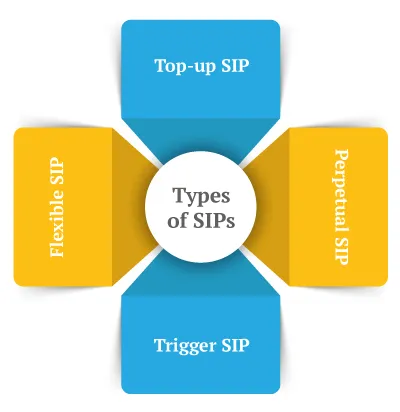

Top-up SIPs are also known as step-up SIPs. Here, you increase your SIP contribution periodically. For instance, if you are currently doing a SIP of Rs. 5,000 monthly and the yearly top-up rate is 10%, the next year, your SIP amount will be Rs 5,500. Thus, with top-up SIPs, you can keep increasing your SIP on a yearly basis. The idea of top-up SIPs is that you should increase your SIP amounts in line with your annual increments. Top-up SIP allows you to generate more wealth as compared to regular SIPs for a given period as you incrementally invest more every year.

Perpetual SIP is the same as regular SIP but does not have a fixed investment tenure. In this type of SIP, you have to keep investing until you request the fund house to stop your SIP. This SIP gives you the advantage of long-term compounding; you do not have to worry about SIP renewals. However, you can redeem your investment anytime.

In trigger SIPs, investments happen only when a specific event occurs in the market. This specific event can be a favorable market movement or a predetermined NAV level. To profit from this type of SIP, you must have an understanding of the market. Thus, this SIP is meant only for experienced investors with the required time and adequate knowledge. If you are a hands-off type of investor, this SIP is not for you.

Flexible SIPs give you the flexibility to make changes in your SIP investment. This change can be in terms of the SIP amount or the frequency of SIP. If you want to make changes in your SIP terms, you can intimate that to your fund houses, but remember that this change should be communicated one week prior to the next due date of SIP. A flexible SIP allows you to increase or decrease your SIP contributions on the basis of market conditions. For example, if the markets are high, you can decrease your SIP; conversely, in the case of a falling market, you can increase your SIP. In the same way, if there is a change in your income, then you can increase or decrease SIPs accordingly.

SIPs provide access to a wide range of mutual funds, allowing you to diversify your investment portfolio across various asset classes, sectors, and market segments. This diversification reduces your overall investment risk and enhances the potential for higher returns.